/cbre_logo.png?sfvrsn=eac6e070_4)

Unparalleled Commercial Real Estate Intelligence

Sector and market analytics

Thought leaders abound

Advantage is CBRE

Which data are right for you?

Econometric Advisors' blog

New EA Forecasted Asking Rent Series: Methodology for Office and Industrial

A unique element of EA’s value stream is the management, improvement, and development of rent “price determination models” and the identification and evaluation of those rent inputs and resulting outputs on an ongoing basis. The debate on how to best present this rent research and how to fairly measure aggregate changes in rents is ongoing.

The primary challenges in developing a reliable rent index is that suite level rent observations are missing observation attributes, tend to be volatile quarter to quarter and carry an inherent risk of not comparing buildings of similar status and space. Establishing a true measure of rent movement requires many pieces of information, meticulous processing, and creativity in the absence of transparency.

EA sources its suite-level historical rent observations from CBRE (in some markets, nearly 80% of observable rents) and CoStar. While these sources provide a good number of observations, a myriad of known issues exist including the completeness of observations, definition differences, and classification of rent types. In addition, in periods of low availability, sample size tends to be small. Rents are observed in two main categories: asking rents (gross or net) which represent the asking rent figure or “headline rent” at the time the space is being marketed, and net effective rent which represent the agreed upon base rent per month, free-rent periods and/or scheduled rent escalations, length of lease, tenant cash allowances and other fees incurred during the term of a lease. Since both asking rents and net effective rents contain detailed attributes, rent observations tend to further fragment the already low sample into non-comparable subsets.

It is rare for a building in EA’s dataset to have a complete history of asking rents. Additionally, outlier detection is employed, and rents are checked and/or automatically filtered for accuracy depending on the type of rent observation. In addition to gaps in the periods of history for each building, there have been changes over time in the collection methods and criteria. Where appropriate, these periods have been identified and various methods of scaling have been meticulously employed to correct for these variances. EA expends great effort on data sourcing, collection, outlier detection and integrity enhancements to improve the quality of our series input data and solve for challenges.

EA ASKING RENT SERIES

In partnership with EA’s founder, Professor Bill Wheaton from the MIT Center of Real Estate, we developed a new rent series that leverages a repeat rent methodology – the gold standard in economics – and at the same time achieves granularity through rent interpolation at the building level. By implementing a growth rate aggregation method, we use a chain-linked method to aggregate buildings to submarkets and higher levels of aggregation. This overcomes any issues caused by the change in the sample over time. This approach also provides flexibility to aggregate building sets based on various building characteristics and/or boundaries and delivers a reliable asking rent index of rent movements over time. Not only that, this research will be used to inform a net effective rent index that is currently in development and will replace our legacy TW rent index.

STEP 1 – ESTABLISH A REPEAT RENT

The repeat rent approach uses rent observations within buildings that have multiple asking rent values captured in its history. We construct this index by comparing rents of the same buildings, so we can avoid comparing rents between different properties, which tend to be heterogeneous. This is similar to the methodology used for constructing the well-known S&P CoreLogic Case-Schiller Home Price Indices. To include more rent information, the model uses both net and gross asking rent depending on availability and includes a dummy variable that controls for net/ gross differences. We also include a dynamic filter which removes outliers each quarter.

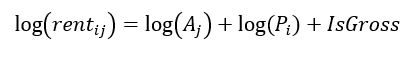

The model we used is below:

Where:

The time fixed effect is what we refer to as the repeat rent. This is the change in rent after having controlled for property fixed effects and whether the rents are gross or net. The methodology produces an index rather than a monetary value. The final outputs are monetized at a later stage (see p.5). Since this method can separate entity-invariant time effects and time-invariant building level heterogeneity, we can examine the true market movement regardless of the differences that arise over time in the set of buildings with available rent data.

STEP 2 - INTERPOLATE MISSING RENTS

As mentioned previously, since both asking and net effective rents contain detailed attributes, these divisions further fragment the already low sample. However, since we already have a property level fixed effect for each of the properties that go into the regression, we can use this information together with market level repeat rent index to create a new building level rent series.

With the assumption that a building’s rent will move in line with the whole market between the building level data points that we have, we fill in the gaps with the help of the market-level repeat rent index. The relationship between the market reference repeat rent index and the building level data are scaled to make use of all building level information we have.

Figure 1. Example of a building’s asking rent history and interpolated rent

For instance, for the Los Angeles office building in Figure 1, we are trying to fill in the gaps between Q3 2017 and Q3 2018. We first gather the building’s property fixed effect and the time fixed effect for LA in Q3 2017. We then apply the IsGross coefficient since most of its rent observations are gross rent.

Using the model equation above, we obtain the reference rent from Q3 2017 to Q3 2018. We then calculate the increment of historical asking rent from Q3 2017 to Q3 2018. We do the same for the reference rent for the same period. Once we get these two numbers, we know actual asking rent growth each quarter compared to the reference rent.

Then we apply this adjusted increment to the growth of estimated rent from Q3 2017 to Q4 2017. Finally, we add it to the interpolated rent in Q3 2017. (Since we have actual rent data in Q3 2017, we will use the actual asking rent in this quarter as the interpolated rent for Q3 2017. ) This will arrive at the interpolated rent in Q4 2017. We follow the same approach to fill in the interpolated rent in Q1 2018 and Q2 2018.

To achieve consistency, we will also adjust the interpolated rent to either gross or net depending on the market in which the building is located. The non-dominant rent will be adjusted to the dominant one based on a gross/net coefficient obtained from fixed effect regression.

THE FINAL PRODUCT: EA ASKING RENT

The EA Asking Rent series is derived from building level interpolated rent using a bottom-up approach, aggregating from building level to submarket and from submarket to either the major market or market levels. Aggregation is done using a chain-linked index using the previous quarter’s net rentable area (NRA) as the weight and with more volatile data left out of the calculation.

This eliminates potential bias from a change in the sample (for example, from the development of new higher-value buildings or major renovations that increase the floor space). The same methodology is performed on different levels of aggregation. To aggregate building level rent to submarket level and then to major market and market level and Sum of Markets, we took the following steps:

We calculate the quarter-over-quarter growth for each building in each period and perform the dynamic filter at market level (filter out top 2% and bottom 2% every quarter). To get a submarket’s rent growth series, we weight the rent growth of each building using last quarter’s NRA. We aggregate rental growth from submarket to market and market to “Sum of Markets” in the same way. We then convert the weighted growth rates into an index of rent levels. We “monetize” the level indices by benchmarking them to the weighted average of interpolated rent levels in the fourth quarter of the previous year.

The EA Asking Rent series is reported in USD per square foot per year. It will be revised each year when the benchmark rent level moves from Q4 of one year to Q4 of the next. This is unavoidable if we are to have a rent series with the correct time series properties, but which is also expressed in USD. We have chosen to change the benchmark once a year as a compromise that avoids continuous quarterly revisions, but which keeps the benchmark reasonably up to date. Rental growth estimates are not revised (unless there is a change in the underlying data). EA Asking Rents will be implemented in our new Q4 2020 forecasts for office and industrial and we will continue improving it through data quality and model enhancement.

CONCLUSION

The new EA rents series are asking rents while the old Torto-Wheaton (TW) Rent Indices had an element of net effective as well as asking rents built in. Nonetheless, we are convinced of the statistical superiority of the new method and of its greater ability to accurately track market movements. At the same time, we are very aware of the important role of incentives to the market and we have launched a new project to create a granular mix-adjusted incentives series that uses a similar methodology to EA Asking Rents.

With the new methodology for capturing rent movements and a new bottom-up forecasting approach, we have become more flexible in data rendering and more reliable in capturing changes. We believe the combination of these two innovations can provide clients with more accurate insight on market movement and better information on rent in both history and forecast.

THIS DOCUMENT WAS PREPARED BY:

Nathan Adkins

Sr Economist, CBRE Econometric Advisors

Nathan.Adkins@cbre.com

Ibrahiim Bayaan

Economist, CBRE Econometric Advisors

Ibrahiim Bayaan@cbre.com

Jing Ping

Sr Data Scientist, CBRE Econometric Advisors

Jing.Ping@cbre.com

Christina Tong

Economist, CBRE Econometric Advisors

Christina.Tong@cbre.com

Matt Vance

Sr Economist, CBRE Econometric Advisors

Matthew.Vance@cbre.com

Experience The Platform

Have interest? Let's talk. We are happy to discuss your use case and find a program that works for you. Take a moment to fill out our web form and our sales team will be in touch with you.