/cbre_logo.png?sfvrsn=eac6e070_4)

"Build, Baby, Build" to Solve the Housing Crisis

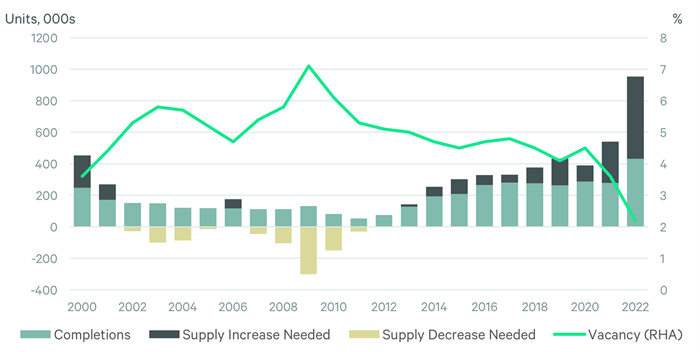

The shortage of housing in the U.S. has been well chronicled. Nationally, multifamily vacancy fell to a record low of 2.3% in Q1 2022, as strong household formation and rising mortgage rates in a tight for-sale market caused multifamily demand to surge.

Developers have been unable to keep up with demand. Despite steady completions, multifamily rents spiked 15.5% for the 12 months ending March 31, 2022. Clearly, more housing supply is needed. But how much?

CBRE Econometric Advisors pegs the shortfall at 521,000 multifamily units based on current and projected demand, vacancy and employment trends. Such a sharp increase in supply would return national vacancy close to the 20-year average of 5.1%. However, a development boom of such magnitude is unlikely. As a result, we foresee no near-term end to the multifamily supply-demand imbalance, even as exceptionally high demand inevitably wanes and vacancy rises naturally.

FIGURE 1: Over and Under Supply of Units Needed to Maintain Long-run Multifamily Vacancy (5.1%)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |