/cbre_logo.png?sfvrsn=eac6e070_4)

Small banks have larger real estate exposure (data available)

Apr 5, 2023, 11:26 AM

by

Matt Mowell

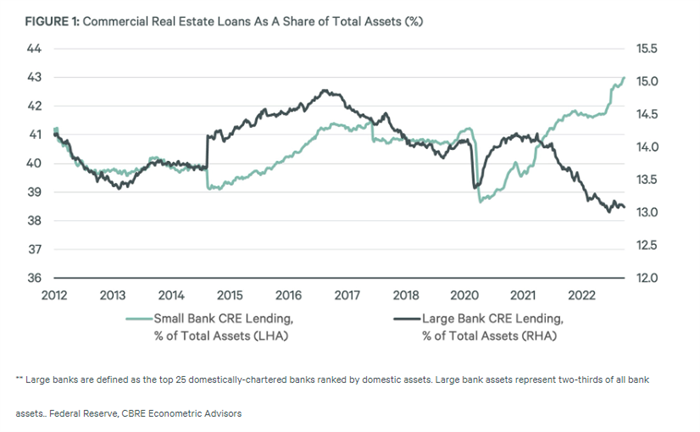

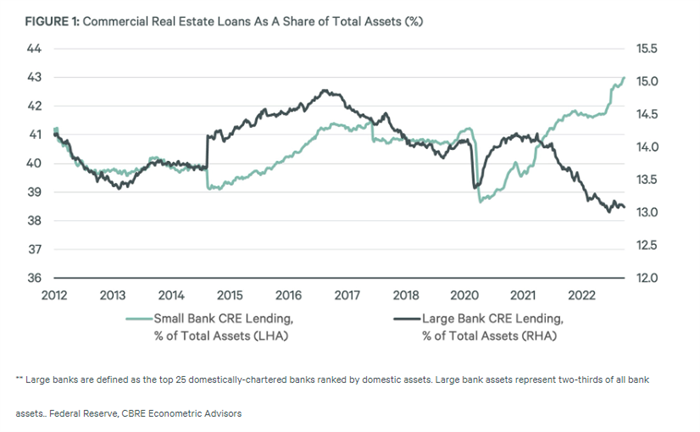

Today, according to the Federal Reserve, commercial real estate loans comprise 43% of smaller banks’ assets. Encouragingly, deals were underwritten at more conservative LTVs than in the years before the Global Financial Crisis, and valuations have grown significantly over the past decade— up 42% for multifamily and 14% for office. This provides some cushion for regional banks amid higher cap rates.

Recent trouble at Silicon Valley Bank and Signature Bank – while unique to those institutions – has focused attention on risks associated with small U.S. banks, particularly their commercial real estate exposure.

Today, according to the Federal Reserve, commercial real estate loans comprise 43% of smaller banks’ assets, much of it in multifamily, which still has relatively healthy fundamentals. While CMBS is the largest source of office sector debt maturing in the next two years, regional banks also have considerable exposure. Encouragingly, deals were underwritten at more conservative LTVs than in the years before the Global Financial Crisis, and valuations have grown significantly over the past decade— up 42% for multifamily and 14% for office. This provides some cushion for regional banks amid higher cap rates.

Regardless, credit markets have tightened and debt capital will be harder to come by and more expensive for commercial real estate investors. The tight credit conditions could cause the economic slowdown that the Fed has been trying to induce, aiding the efforts to suppress inflation. This could allow the Fed to ease monetary policy sooner than expected and set the real estate capital markets up for a rebound later this year.

DOWNLOAD UNDERLYING DATA

Today, according to the Federal Reserve, commercial real estate loans comprise 43% of smaller banks’ assets, much of it in multifamily, which still has relatively healthy fundamentals. While CMBS is the largest source of office sector debt maturing in the next two years, regional banks also have considerable exposure. Encouragingly, deals were underwritten at more conservative LTVs than in the years before the Global Financial Crisis, and valuations have grown significantly over the past decade— up 42% for multifamily and 14% for office. This provides some cushion for regional banks amid higher cap rates.

Regardless, credit markets have tightened and debt capital will be harder to come by and more expensive for commercial real estate investors. The tight credit conditions could cause the economic slowdown that the Fed has been trying to induce, aiding the efforts to suppress inflation. This could allow the Fed to ease monetary policy sooner than expected and set the real estate capital markets up for a rebound later this year.

DOWNLOAD UNDERLYING DATA

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |