/cbre_logo.png?sfvrsn=eac6e070_4)

Performance of REITs and Private CRE is Best Correlated Over Longer Holding Periods

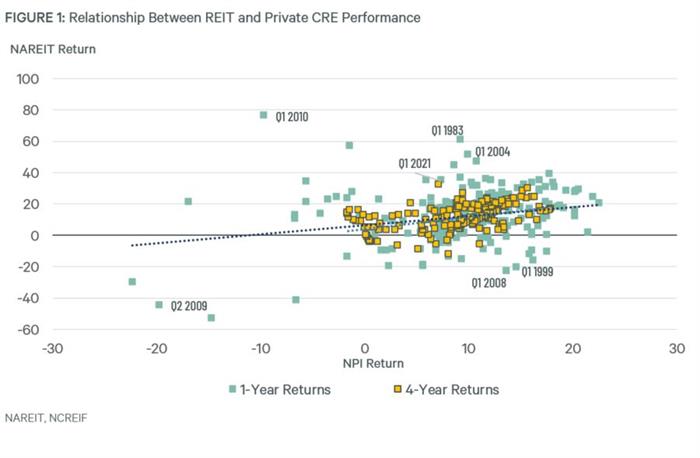

Many multi-asset investors use real estate investment trusts (REITs) to gain or supplement their exposure to property without purchasing the underlying asset. However, over short time-horizons REITs can often mirror the volatility of the broader securities market rather than the steadier, income-driven performance of private equity real estate. The graphic below shows the relations between REITS (NAREIT) and private equity real estate returns (NCREIF NPI) on a one-year and rolling four-year basis.

Shorter-term returns can diverge dramatically with the differential as large as 65 percentage points in one quarter. The greatest disparities tend to emerge during periods of market dislocation and economic change. For instance, in early 1999 and 2008 securities fell significantly due to concerns about stretched valuations and systemic risk. Of course, REITs also saw more volatility on the way up as security markets rallied during the early stages of economic recoveries in 2004, 2010, and 2021.

These large differences largely disappear when examining our longer four-year period. The lesson is clear: short holding periods can produce returns that do not resemble those earned by directly held real estate. In fact, during our sample period, the correlation between four-year returns and one-year returns is nearly double. Investors likely will need to hold REITs for several years to ensure returns are like private CRE.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |