/cbre_logo.png?sfvrsn=eac6e070_4)

Southern California’s outlier markets may provide industrial investment opportunity

Is every real estate deal unique? Or does each deal provide a point in a broader spatial pattern? And if broader patterns can be discerned, are there investment opportunities from identifying market outliers?

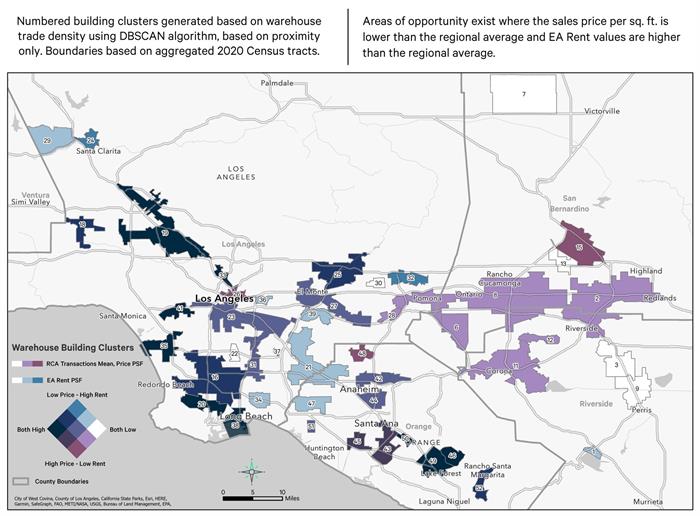

To answer these questions, CBRE Econometric Advisors (CBRE EA) mapped all the industrial property sales in Southern California over the past two years and then applied geospatial analytics to identify trading patterns. We algorithmically identified 47 deal clusters, which are numbered on the map below.

Generally, the clusters overlap the region’s key industrial nodes. To generate a proxy for relative value, we averaged the price per sq. ft. for each property sold and the typical in-place rent within each cluster. Clusters are color coded to illustrate how these metrics relate to the broader regional average.

The results show that clusters in densely populated places with elevated land values tend to achieve both high sales prices and rents. Conversely, despite heavy sale volume, buildings in the Inland Empire traded at average-to-slightly discounted prices, likely reflecting their relatively lower replacement costs and a decade-long construction boom that suppressed rent levels.

The market outliers are the interesting part of this exercise. Investment clusters in Los Angeles County, from Covina (32), south to Buena Park (21), and into the northwestern corner of Orange County (47) generally offer higher rents at a higher price per sq. ft. A similar trend can be found within the far northern tier of Los Angeles County, including in Northridge (18) and Santa Clarita (24).

Industrial properties in many of these markets tend to be smaller and cater to a local tenant base. Thus, they are often not on the radar of institutional investors. Smaller properties with fewer credit tenants may have limited appeal at a time when investors are risk averse. However, as market conditions improve, they may offer a compelling opportunity due to their lower price per sq. ft. and above-average rents, as well as a modest new construction pipeline in the local area.

By Matt Mowell, Jamie Portolese, Franz Limoges, Nicholas Rita, Dennis Schoenmaker, Ph.D.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |