/cbre_logo.png?sfvrsn=eac6e070_4)

Don't fret the uptick in industrial availability just yet

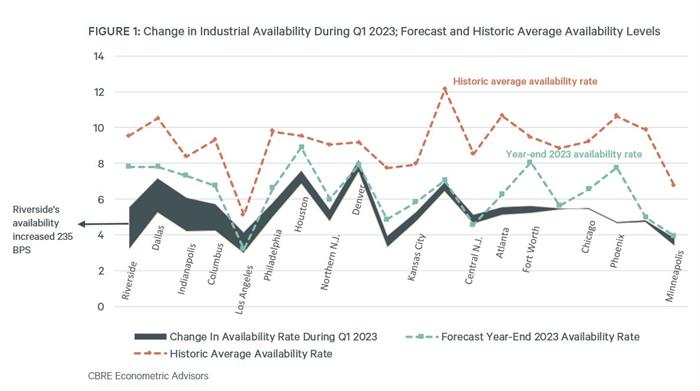

The industrial sector saw a 70-basis-point increase in availability in the first quarter. Availability will likely increase further throughout 2023 as a high volume of new properties are delivered amid a leasing slowdown.

Figure 1 ranks the 20 largest (by inventory) industrial markets by the increase in availability during the first quarter. Notably, port activity has waned in Los Angeles and Long Beach, contributing to increased availability. Midwest hubs like Columbus and Indianapolis have also seen fundamentals soften. Meanwhile, availability in Phoenix held steady during the first quarter and declined in Minneapolis.

But what really matters is where these markets are going. Some large markets will continue to see availability rise through year-end, especially as we expect economic conditions to weaken in the second half. Nevertheless, availability should remain below historic norms for the foreseeable future, a fact that distinguishes industrial from most other property types.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |