/cbre_logo.png?sfvrsn=eac6e070_4)

REIT valuations signal lower private asset values ahead

A few months ago, we compared private and public real estate market performance over time. Our analysis showed how equity market gyrations had a bigger influence on short-term REIT performance than underlying real estate fundamentals. Indeed, private and public real estate performance (total returns) only come into alignment after four years (on a rolling-period basis).

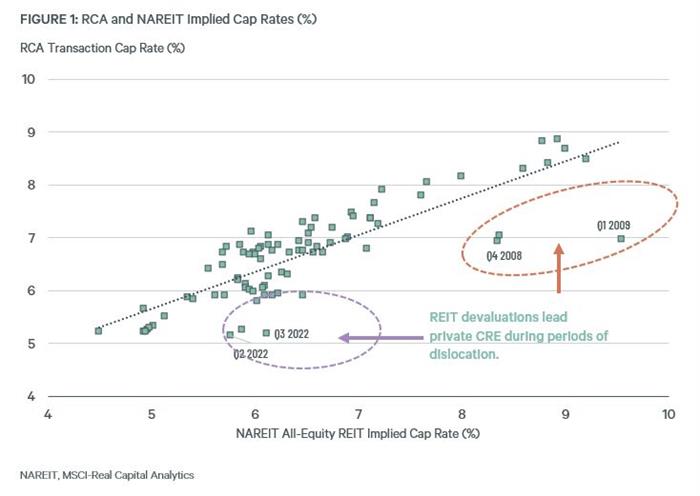

So, REIT prices are a weak signal for private equity real estate values — or are they? Figure 1 examines the relationship between quarterly NAREIT implied cap rates, which are more stable than total returns, and MSCI-RCA transaction cap rates. Generally, REIT and private-market cap rates align over time, but periods of persistent disconnect are readily apparent — and they send an important pricing signal. In 2008-2009, private deal flow came to a virtual halt while public investors aggressively discounted REIT asset values, and these discounts were eventually reflected in private-market cap rates.

We are in a similar situation today. Transaction activity is down due to wide bid-ask spreads. Meanwhile, REIT implied cap rates have increased sharply, particularly for office space, as manifested in significant discounts to NAV. But a few distressed office asset sales suggest that REITs are on to something, and private-market devaluation will catch up soon.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |