/cbre_logo.png?sfvrsn=eac6e070_4)

Rental housing could benefit from a softer for-sale market

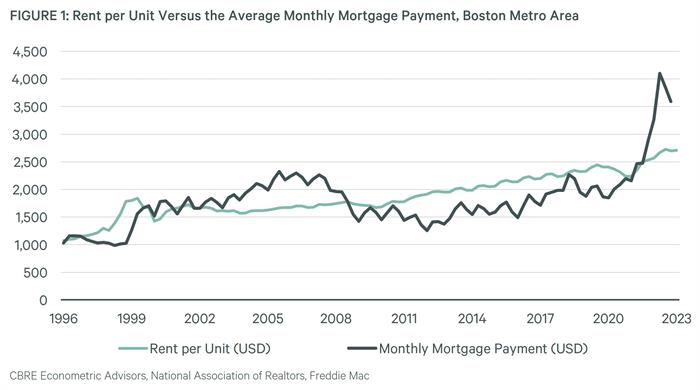

With record home prices and rising interest rates, more and more people have chosen to rent, especially in high-cost markets such as Boston.

Historically, the cost of homebuying has been more volatile than renting due to rapid swings in interest rates. The last time it was cheaper to rent than buy was during the years leading up to the 2007 housing crash, when capital flooded the for-sale market. This was followed by a decade of relatively low ownership costs due to rock-bottom interest rates and much stricter lending criteria, which thinned the pool of potential homebuyers. Today, the situation has flipped. The residential market is dealing with the aftermath of hot housing demand from 2020-2022 as well as surging mortgage costs.

If we assume that the costs to buy and rent move in sync over the long run, is it possible that for-sale prices can fall while rents continue an upward march? It is likely that mortgage rates will ease in coming quarters providing some relief to homebuyers. But supply-constrained markets, such as Boston, are unlikely to benefit from more for-sale development activity. While the rental market faces macroeconomic headwinds over the next year, as discussed last week, stubbornly high for-sale costs will at least be a tailwind for rents in the medium-to-longer term.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |