/cbre_logo.png?sfvrsn=eac6e070_4)

The U.S. economy faces continued challenges

Recession fears have been top of mind, but an upbeat labor market, the resilient consumer, stronger-than-expected corporate earnings and falling inflation have engendered hopes from some observers of a so-called “soft landing.”

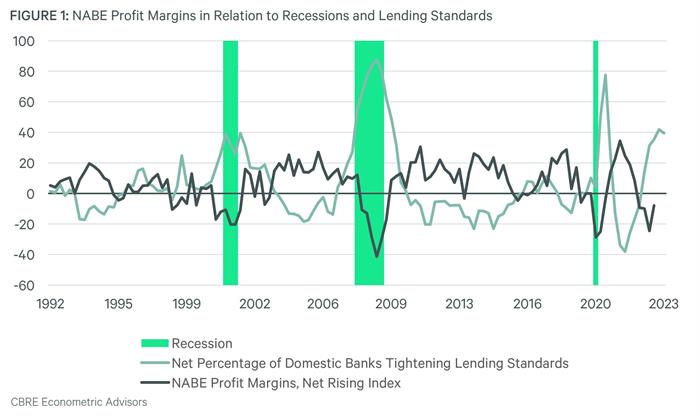

However, the American economy continues to have real vulnerabilities and is exhibiting signs that often signal a recession. A few examples include a dramatic tightening of lending standards and high borrowing rates and operating costs, which have reduced profit margins. Declining margins typically precede a fall in investment and hiring activity. Figure 1 shows the rise and fall of net profit margins based on the National Association for Business Economics (NABE) profit index, and how it is correlated with both lending standards and recessions.

These data sets underscore that economic conditions are fragile and growth could easily stall. We also need to bear in mind that the consumer—the bulwark of the U.S. economy—faces diminished savings and higher debt costs that make an acceleration in spending unlikely. Thus, CBRE Econometric Advisors continues to believe that the lagged effects of tighter financial conditions will result in a moderate recession in early 2024.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |