/cbre_logo.png?sfvrsn=eac6e070_4)

Multifamily rent growth to persist where least expected

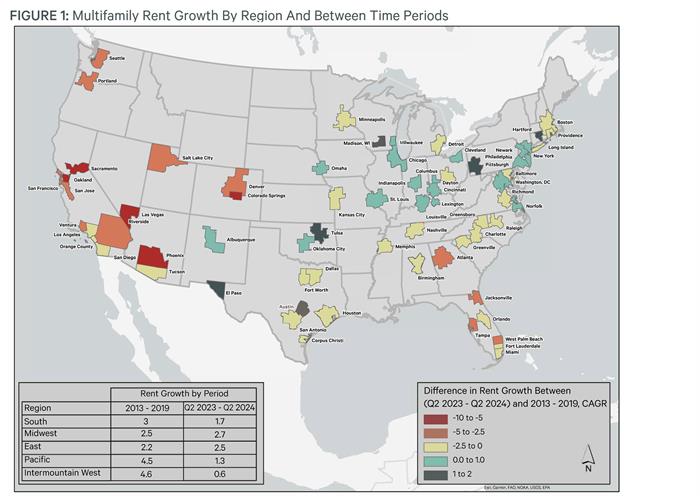

To no one’s surprise, multifamily growth is slowing from the pre-COVID trend and certainly from recent years. This is evident on the map, which depicts how the rent outlook for the next year (Q3 2023 to Q2 2024) compares with the actual growth over the previous cycle (2013 to 2019).

Where rents are slowing the most is more surprising.

Counterintuitively, we expect rent growth to remain stable in typically slow-growth markets across the Midwest and Northeast. Many do not attract significant development activity and the lack of new supply is now a tailwind. Multifamily here will also benefit from the illiquid for-sale market nationwide. Outmigration continued last year across many Midwest and Northeastern cities, but we could plausibly expect this trend to ease in 2023 and 2024 as fewer people are likely to make interregional moves for the purpose of homeownership.

Conversely, with the tech boom fading, multifamily rents are decelerating sharply across Northern California and the Pacific Northwest. Rent growth is weakening across the West, in Denver, partly due to weaker in-migration, and Phoenix, due to overbuilding. Overall, average annual rent growth in the mid-4% range is expected to give way to increases of just 1.3% on the Pacific Coast and 0.6% in the interior West over the next year.

Oversupply also poses challenges across the Sun Belt where new construction added more than 3% to the inventory in some markets during the past four quarters. We believe inventory growth pressure will be exacerbated by weaker job growth and slower household formation over the next year. This suggests that multifamily asset performance is likely to fall short of pro forma in much of the U.S. for a period of time. However, Midwest and Northeast markets are best positioned for this tougher market environment.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |