/cbre_logo.png?sfvrsn=eac6e070_4)

The current office absorption trend is not new and that may be a good thing

Remember in 2020 when economists said COVID put many existing trends on steroids? E-commerce, out-migration from high-cost cities and remote work, to name a few.

Fast-forward to 2023, and many pandemic-accelerated trends are reverting to the mean. Both e-commerce sales and industrial & logistics leasing have moderated and multifamily vacancies in Manhattan are again the lowest nationally.

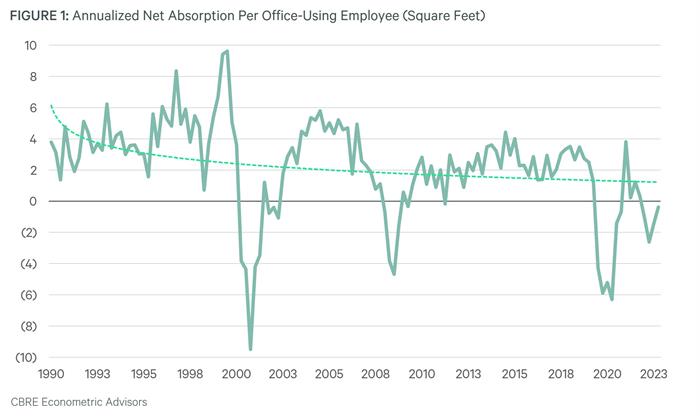

What about office leasing? For decades absorption per office worker has trended down as companies adopted more efficient open-office plans and more people worked remotely.

At the depths of the pandemic, net absorption per office worker plummeted below Global Financial Crisis levels to -6.3 sq. ft. Per-worker absorption bounced back in late 2021, only to fall again under the weight of rising interest rates, economic uncertainty and diminished payrolls, particularly in the finance and tech sectors.

It is unlikely that per-worker absorption will return to late 1990s levels anytime soon, reflecting the impact of widespread remote work. However, we expect absorption will likely revert to the long-term trendline in the range of 1 to 2 sq. ft. per worker as economic conditions improve and companies achieve better balance between their requirements and the desires of their employees.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |