/cbre_logo.png?sfvrsn=eac6e070_4)

Class B LEED Office Buildings Offer Noteworthy Opportunities

Most U.S. markets have a sizeable enough inventory of LEED*-certified office buildings to draw meaningful performance comparisons with non-certified buildings.

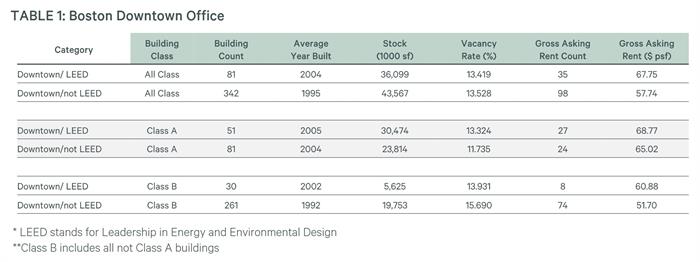

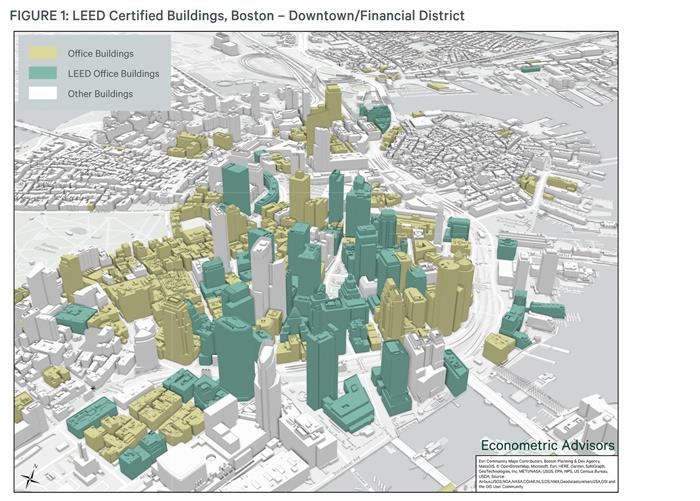

We chose to analyze the Downtown Boston market where just over one in three Class A buildings and one in 10 Class B** buildings have been certified.

Our analysis demonstrates that LEED certification provides greater relative performance benefits for Class B buildings than for Class A assets. Class B LEED properties have an average 180-basis point (bp) lower vacancy rate and a $9.18 per sq. ft. asking rent premium compared with non-LEED Class B properties. This is a wider delta than for the Class A cohort, where LEED buildings have a 160-bp lower average vacancy rate and a $3.75 per sq. ft. asking rent premium. So the Class B LEED rent advantage over non-LEED is roughly three times larger than the premium commanded by Class A LEED properties.

These findings substantiate CBRE Research’s Fall 2022 report, Green Is Good: The Enduring Rent Premium of LEED-Certified U.S. Office Buildings | CBRE UK.

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |