/cbre_logo.png?sfvrsn=eac6e070_4)

The gap between the top and bottom multifamily markets will be narrower than usual in 2024

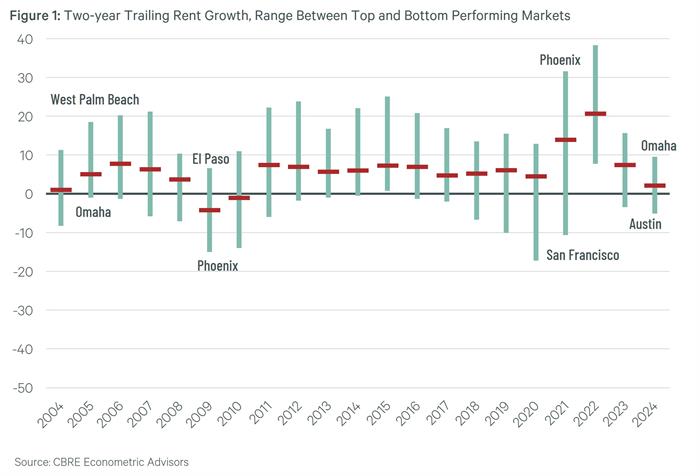

CBRE EA has spilled much ink highlighting how multifamily new construction will suppress rental growth. A quarter of all markets, mainly across the South and West, will see rents decline on a rolling two-year basis in 2024. This resembles the market performance in 2020 but is much better than 2009, when 81% of all markets suffered rent declines.

However, the gap between the top markets (generally Midwest cities with little supply growth) and bottom markets (generally Southern cities with aggressive supply growth) is narrower than usual.

We are seeing a smaller performance gap among markets because slower economic growth will constrain rents nationally, not just in Sun Belt markets with significant supply risk. Rent growth for the median multifamily market will slow to just over 2% this year, its lowest level since 2010. The upshot is that short-term performance will be only partly driven by differences among markets, and properties will need strong asset management to generate better-than-average returns.

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |