/cbre_logo.png?sfvrsn=eac6e070_4)

Multifamily market travails not likely to last

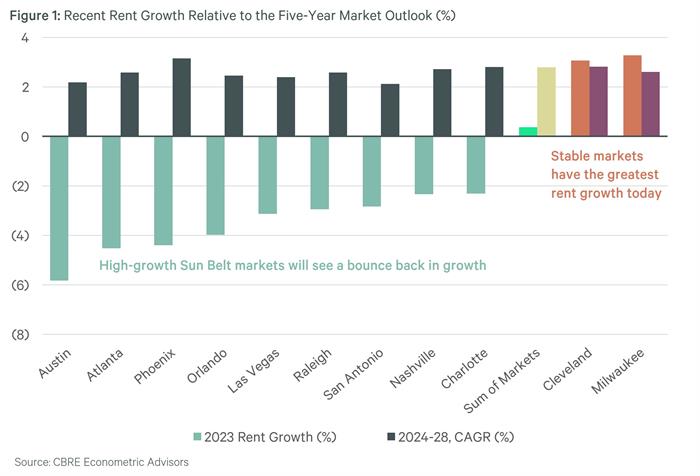

Multifamily rent growth has departed from historical trends in many markets, including those in the Sun Belt that have long been associated with vigorous growth. Meanwhile, landlords still have leverage to raise rents in traditionally slow-but-steady cities like Cleveland and Milwaukee.

Markets are never static and strong rent increases are likely to resume in traditionally higher growth cities as excess supply is absorbed. The bounce back will likely be sharpest in Phoenix, Charlotte and Nashville. Interestingly, higher rent expectations, paired with increased going-in yields, will likely bolster investment performance in these markets. But a market like Austin, where supply grew 6% in 2023 – three times the national average – will take longer to recover. Meanwhile, Cleveland, Milwaukee and similarly situated markets will see slightly slower rent growth but will continue to benefit from stable fundamentals and higher-than-normal barriers to homeownership. Traditionally, Midwestern cities have touted attractive affordability levels, but limited inventory and high mortgage costs are increasing the number of renters-by-necessity in those markets too.

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |