/cbre_logo.png?sfvrsn=eac6e070_4)

Industrial leasing likely will improve, though all markets won’t benefit equally

Industrial real estate has faced challenges for the past two years as the pandemic-era e-commerce boom and strong consumer spending triggered a burst of construction activity. New supply hit the market in 2022 and 2023, just as demand for space was tapering off, particularly for companies in sectors that are interest rate sensitive. Leasing activity is expected to improve this year, especially if the Federal Reserve follows through on anticipated interest rate cuts. All markets, however, won’t fare equally.

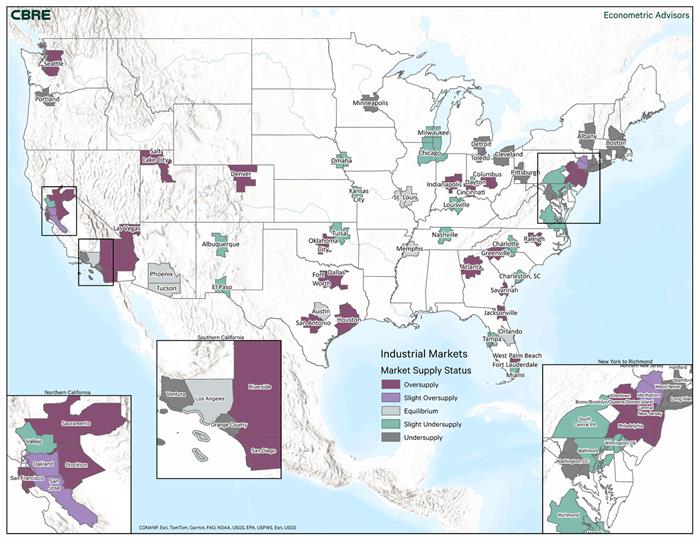

Right now, Phoenix appears to be in equilibrium, with new construction matching demand and a stable availability rate. However, continued strong completions threaten to push the market into oversupply by year end, depending on how well absorption holds up. Riverside is one of the markets that has already tipped into oversupply. Robust construction has outpaced demand, putting pressure on taking rents. Los Angeles appears well positioned to stay in equilibrium. The impediments to construction, including stringent local zoning and entitlement processes, temper new supply growth, benefiting rental rates. Boston will likely remain undersupplied for the foreseeable future. Since it’s land constrained, Boston sees very little supply growth and demand is relatively modest because, as a distribution hub, it mainly serves the New England market, a smaller geography than larger industrial markets serve.

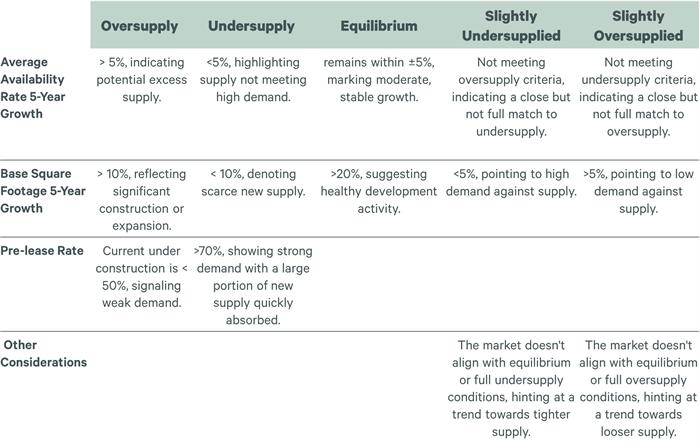

Anticipating when an industrial market may be about to become oversupplied or undersupplied is key to making well-timed investment decisions.

The table below details the criteria for the five stages of the market used to perform this analysis.

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |