/cbre_logo.png?sfvrsn=eac6e070_4)

Approaching a New Normal for Office Sector

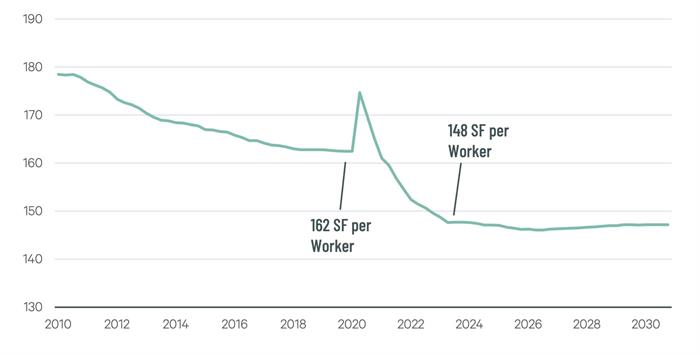

Despite the well-publicized challenges facing the office sector, signs of supply/demand equilibrium are emerging. Office rightsizing appears to be nearing an end as most companies have adjusted their lease commitments and are becoming more insistent about employees returning to the office. Sublease vacancy has begun to decline and occupied space per employee appears to have stabilized at 148 sq. ft. or 9% below the pre-pandemic level. However, reductions in space per employee pre-dated the pandemic as companies have long sought greater efficiencies and many allowed remote work arrangements. Given this backdrop, CBRE EA believes the overall office vacancy rate will peak at approximately 20% by 2025.

Figure 1: Occupied Space per Employee, Square Feet (SF)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |