/cbre_logo.png?sfvrsn=eac6e070_4)

How capital allocations to the office sector are changing

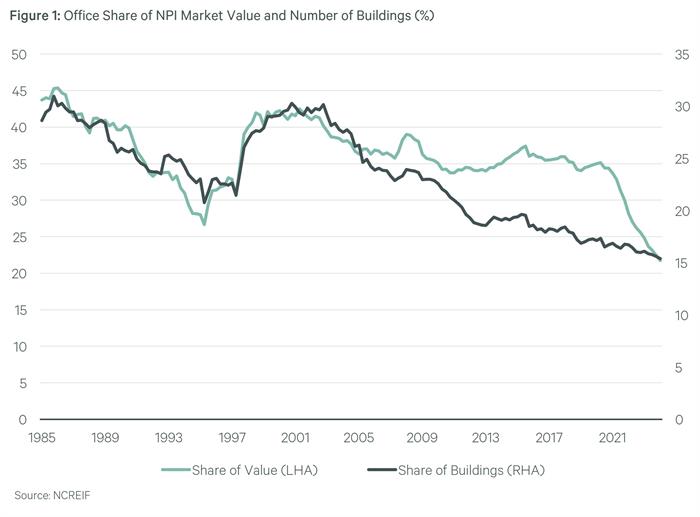

Office has shrunk to just 22% of the NCREIF Property Index (NPI), down from a cyclical peak of 37% in 2015. Office has fallen in and out of favor before. Recall the painful late 1980s/early 1990s bust where oversupply was pervasive, which ultimately gave way to a late 1990s boom fueled by an emerging tech sector and capital rediscovering commercial real estate.

Yet office’s recent decline has been more secular than cyclical. Even before COVID-19, multifamily and industrial commanded a greater share of the NPI at the expense of office. Drivers behind this secular shift include fund managers seeing better growth prospects in industrial and multifamily properties. It is also plausible that office portfolios within the NPI were rebalanced towards higher-value properties. We see evidence of this in office's contribution to the NPI’s market value, which has been much steadier than the sector’s share of actual buildings in the index.

Office's share of the NPI likely will remain subdued as pricing adjusts and until fundamentals improve. In the meantime, office’s share of the NPI will likely be weighted toward prime assets in the best submarkets that are positioned for outperformance.

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |