/cbre_logo.png?sfvrsn=eac6e070_4)

Double-Digit Class B&C Office Cap Rates Are Commonplace

Earlier this year we reported that Class C office yields often exceed junk bond levels. Today double-digit cap rates have become pervasive for Class B and C properties.

Although office sales volume has been thin, CBRE’s Cap Rate Survey (CRS) offers fresh insight into how high yields have climbed for marginal buildings.

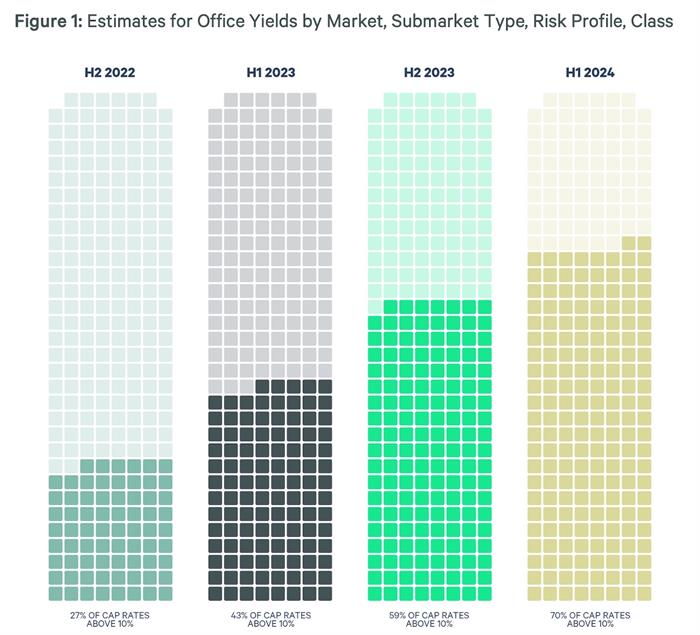

In the graphic below, each square represents a market, submarket type, risk profile and class – for example, Dallas, Suburban, stabilized, Class B office. The dark shaded squares represent cap rates that are estimated to be 10% or higher. As you can see, the percentage of such properties has grown exponentially over the past year and a half.

We can take some solace in the fact that the growth of above-10% cap rates has slowed to 18% in H1 2024 from 56% in H1 2023. Further, most CRS participants expect that office yields will remain flat or slightly decline in coming quarters. This corresponds with other evidence that office market fundamentals are beginning to stabilize.

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |