/cbre_logo.png?sfvrsn=eac6e070_4)

Divergence in absorption trends likely to persist

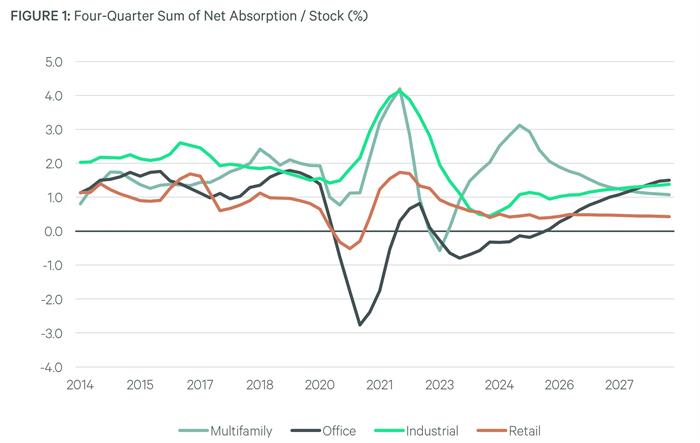

Prior to 2020, net absorption generally moved in a similar direction across property types. The pandemic upended this pattern, with notably dire effects on office absorption.

Looking ahead, we anticipate a continued divergence in absorption trends. Of all the sectors, industrial and retail should resume a normalized pattern that resembles the previous upcycle. However, retail absorption should moderate because available space is so limited.

Multifamily is poised for the best absorption, mainly due to the high barriers to homeownership. However, a commensurate supply response will check rental growth.

The office sector is inching toward stabilization with most markets now reporting positive net absorption. However, the rolling four-quarter trend (depicted in the chart below) remains in the red.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |