/cbre_logo.png?sfvrsn=eac6e070_4)

Developer discipline will help usher in the office recovery

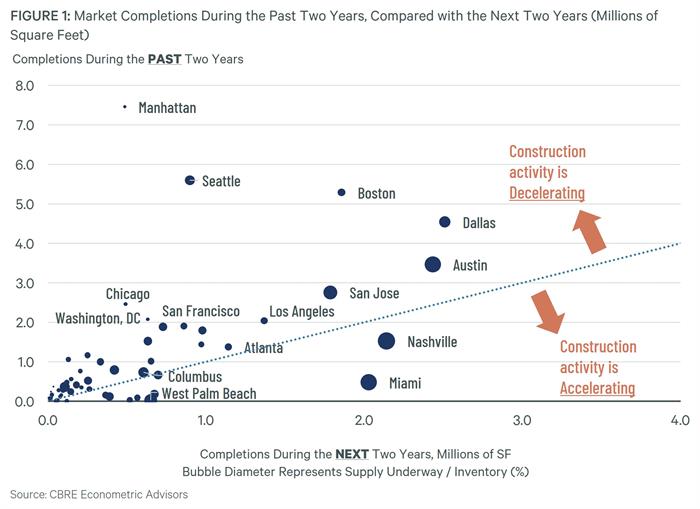

Predictably, office development has decelerated in most markets. Over the next two years, office completions are expected to exceed the previous two years’ levels in 12 markets—or 19% of the office markets CBRE EA tracks. Key outliers include some South Florida markets, namely Miami and West Palm Beach, where the office market has had strong momentum since 2020. In Miami, future deliveries are 3.9% of total inventory. Nashville deliveries are also elevated at 4.5% of inventory.

The construction slowdown is particularly evident in large, mature office markets, such as Manhattan, Seattle and Washington, D.C. Also, rising cap rates have resulted in steep discounts to replacement costs in these expensive-to-build cities, making ground-up development even less viable. Interestingly, construction is decreasing just as leasing activity is increasing. This means the 1 million sq. ft. of construction underway in Manhattan—a miniscule 0.1% of inventory—is not likely to impede the market’s recovery and would be welcome for tenants looking for state-of-the-art premium space, which is in relatively short supply.

With so many large markets facing similar circumstances, the national office vacancy rate is expected to decline by 60 basis points over the next two years.

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |