/cbre_logo.png?sfvrsn=eac6e070_4)

Private Investors Dominating Office Activity Since 2020

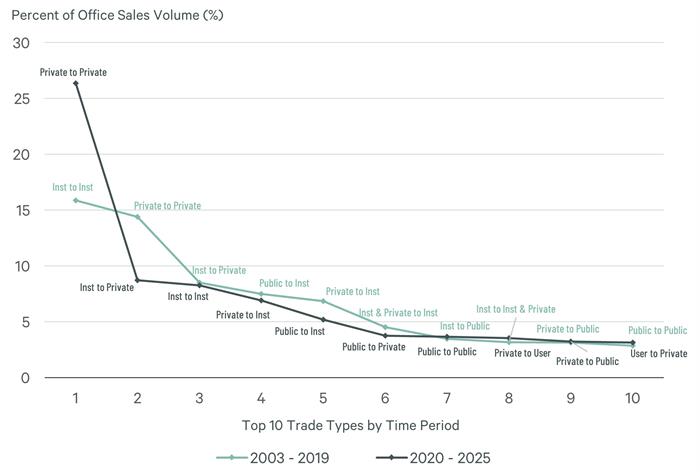

Accompanying the recent decline in office investment activity has been a change in the profiles of those trading. The chart below tells the story.

Comparing investment sales from 2003 to 2019 and from 2020 to February 2025 shows that private buyers (Developers/Owner/Operators, high-net-worth individuals and non-traded REITs) have dominated activity in recent years. For example, deals in which a private buyer bought assets from a private seller have accounted for 26% of total volume since 2020, up from 14%, in the 2003-2019 period. Conversely, institutional investors (banks, endowments, equity funds, insurance companies, investment managers, pensions, and sovereign wealth funds) have become decidedly less active. Institution to institution trades accounted for just 8% of total sales volume since 2020, about half the level from 2003 to 2019.

This trend may be driven, in part, by an inherent risk aversion among institutional investors, which shy away from properties that can often offer yields that rival junk bonds. The operational and construction expertise of many private investors also makes them advantaged buyers at a time when so many office properties need upgrades and repositioning.

Figure 1: Top 10 Unique Office Buyer & Seller Type Combinations by Period

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |