/cbre_logo.png?sfvrsn=eac6e070_4)

Double-digit office cap rates start to plateau

By Tyler Deckard, Michael Leahy, Matt Mowell

Office investment activity is slowly reviving, with most capital targeting higher quality buildings with stronger occupancy levels and better NOI prospects. Meanwhile, the Class B&C segments continue to struggle.

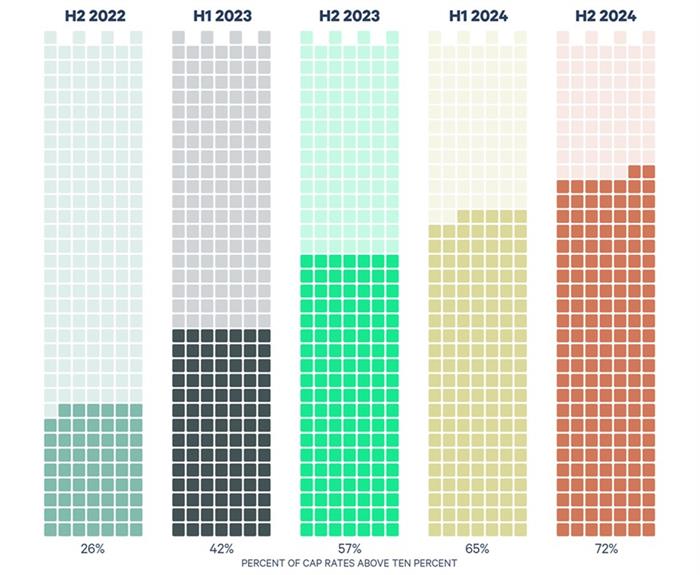

CBRE’s Cap Rate Survey (CRS)1 provides insight into the upward drift of yields for marginal properties. The graphic below shows the percentages of Class B & C office properties with an estimated double-digit cap rate across the past five surveys. While the percentage reached a new high in H2 2024 (72%), the increase was far less pronounced than even a year earlier. This provides more evidence that the office market is finding a new equilibrium.

1The CRS asks CBRE capital markets and valuation professionals to estimate office yields by market, submarket type, risk profile and class across 36 geographic markets.

Figure 1: Estimates for Office Yields by Market, Submarket Type, Risk Profile, and Class

- Christina Tong (34)

- Daniel Diebel (20)

- Dennis Schoenmaker (36)

- Franz Limoges (26)

- Jing Ren (20)

- Matt Mowell (190)

- Michael Leahy (35)

- Stefan Weiss (30)

- Tyler Mangin (8)

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |