/cbre_logo.png?sfvrsn=eac6e070_4)

Retail Availability: Perception versus Reality

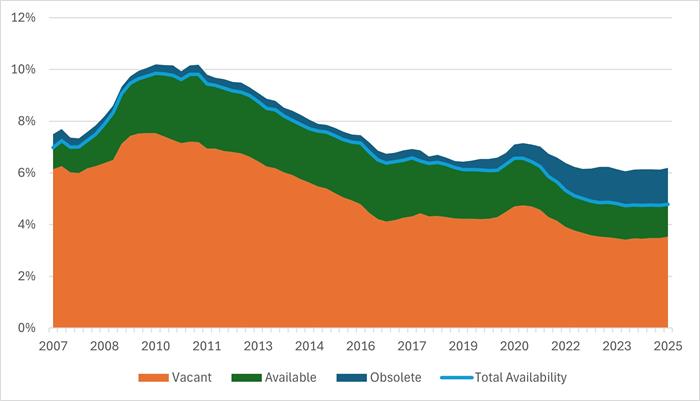

The U.S. retail market has faced increasingly limited availability in recent years. From 2010 to 2024, the U.S. retail footprint grew by just 10%, compared with an 11.6% increase between 2005 and 2009. Tepid new development has led to a record low availability rate of 4.8% in Q1 2025.

However, perceptions about the retail market are often colored by a growing supply of obsolete space, which has tripled since 2020. Most of this space is uninhabitable by retailers. Including it in availability only pushes the rate up to 6.2%.

Overall, the paucity of available space has given landlords significant leverage in lease negotiations. Retail rents rose 2.4% Y-o-Y in Q4 2024, outstripping the 10-year average of 2%. Even if higher tariffs shake consumer and retailer confidence, rents are likely to march higher in the face of limited availability.

Figure 1: Availability, Vacancy, and Obsolescence Rates (%)

Source: CBRE Econometric Advisors

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |