/cbre_logo.png?sfvrsn=eac6e070_4)

Simulated Examples of the CRE Debt Funding Gap

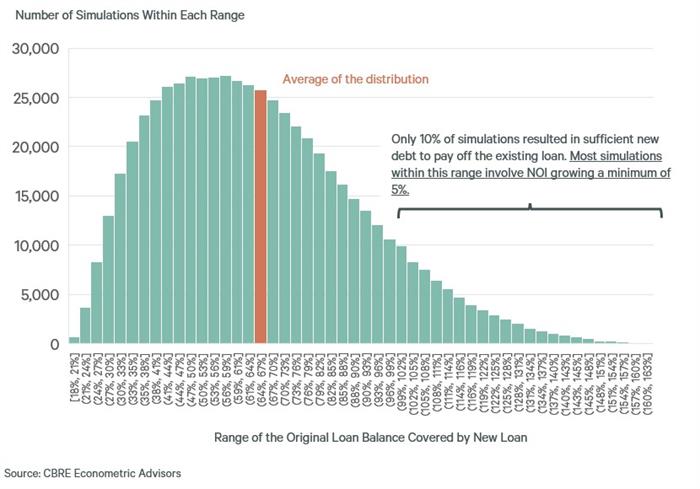

The office debt funding gap arises when changes in property value or lending conditions cause the debt available to refinance a property to be less than its outstanding mortgage balance. Previously, we measured the potential aggregate gap using estimated loan maturities, property value changes and current loan-to-value ratios (LTVs). In this analysis, we estimate debt funding gap potential sizes based on hypothetical values.

We modeled an office property loan originated in 2019 with the following characteristics: 4% interest rate; $10 million Net Operating Income (NOI); 5% cap rate, $200 million total value; 72% LTV; $144 million loan balance and $480,000 monthly payment. The debt service coverage ratio (DSCR) was 1.74 and the debt yield was 6.94%. We simulated 611,226 scenarios to estimate the size of the funding gap if a loan were to mature today, using all unique combinations of the following parameters:

- NOI: Decreasing or increasing up to 50% in 5% increments.

- LTV: Declining from 0% to 20% in 1% increments.

- Interest Rate: Increasing from 0% to 5% in 1% increments.

- Cap Rate: Increasing from 0% to 5% in 0.5% increments.

- Amortization: Percentage of original balance amortized ranging from 0% to 20% in 1% increments.

In addition, we assumed a minimum DSCR of 1.25 and a minimum debt yield of 8%.

Under these simulations, a typical new loan originated today would cover only 65% of the outstanding balance, requiring fresh equity or additional debt to close the 35% debt funding gap. A new loan would be large enough to pay off the existing loan in only 10% of our simulations, and 99% of these scenarios required NOI to grow by at least 5%, an unattainable growth rate for most office properties in recent years. Of the 144 scenarios that involved no NOI growth and no debt funding gap, the minimum amortization level was 18%.

Although many simulations are more extreme than what most office investors face today, the overall results paint a grim picture of the troubled state of capital structures, especially for properties financed in 2019 – arguably the worst year to have acquired an office asset.

Figure 1: Distribution of Percent of Original Loan Balance Available at Refinance Across Simulations

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |