/cbre_logo.png?sfvrsn=eac6e070_4)

Discretionary Retailers Taking Headwinds In Stride

Discretionary retailers appear well-positioned to face any near-term headwinds from policy uncertainty and rising operating costs given their wider margins backed by firmer financials.

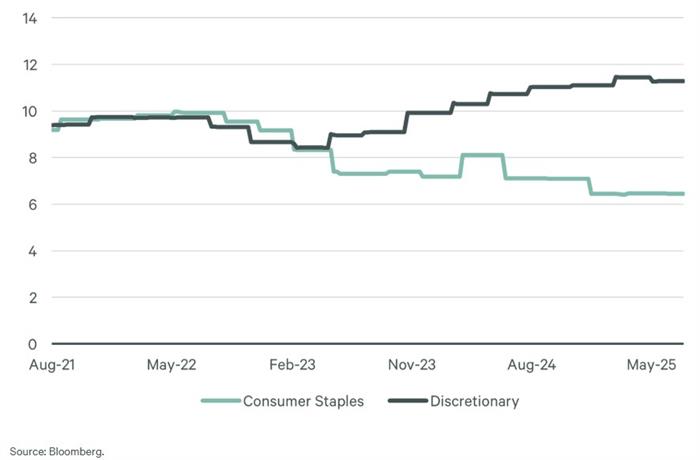

The economic stimulus during the COVID-19 pandemic boosted the spending/purchasing power of the consumer, which benefited both discretionary and staple retailers. By 2023, though, a divergence emerged between the income statements of both consumer staples and discretionary retailers. Discretionary retailers were able to improve their operating margins during the past two years due to their pricing power. In contrast, grocers, pharmacies and other staple retailers could no longer fully pass on higher operating costs to consumers, eroding their profit margins.

Discretionary retailers have also benefited from a strong stock market, which supports the financial position of more affluent households. Revolving credit has contracted by 2.5% over the past year. This has made income growth the primary support for retailer margins. It also underscores how vulnerable all retailers may be if the labor market weakens. This environment also favors retail centers that have replaced struggling tenants with financially sound ones.

Figure 1: Gross Operating Margin (%) Differences Between Consumer Staples and Discretionary Retailers

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |