/cbre_logo.png?sfvrsn=eac6e070_4)

Investors Need to Amass a Big Portfolio to Achieve Market Level Rent Growth

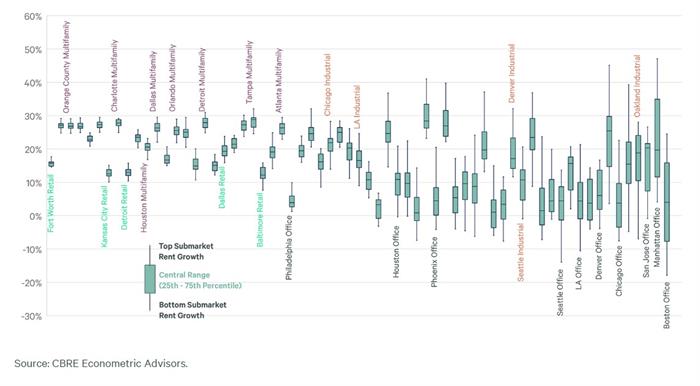

How many buildings does an investor need to own for their portfolio’s performance to match the broader market? In larger markets, the answer is likely dozens, given various submarkets – each performing differently – that comprise major cities. For this reason, anyone allocating investment capital across markets should consider the rent dispersion of each market.

Figure 1 displays a box-and-whisker plot for every U.S. market with at least 15 submarkets. Each box shows the submarket-level projected rent growth (2025-2034) in the 25th to 75th percentile. The lines show the broadest range of projected submarket rent growth within each market. The market with the least rent growth dispersion is Fort Worth retail—potentially reflecting the pervasive presence of shopping centers in this high-growth market.

Meanwhile, markets on the right have the greatest rent dispersion. Manhattan exemplifies this with projected rent growth ranging from 4% to 47%. This yawning gap reflects the mix of tenants, building quality and amenities of the submarkets that comprise Manhattan. Boston is similarly diverse, with traditional office markets like the Route 128 corridor and urban submarkets like Seaport and East Cambridge that are populated by professional services and technology firms and that have attracted considerable new development.

In general, office and industrial markets tend to have more rent dispersion than retail markets, potentially reflecting the significantly different building and tenant type in each office and industrial submarket.

Where possible, investors should prioritize submarket-level rent forecasts over market-wide projections. They will need to own multiple properties to match market-level rent growth, especially for high-dispersion markets.

Figure 1: Dispersion of Submarket Forecast Cumulative Rent Growth Within Each Market

What's Next?

Watch Now: 2024 Outlook WebinarAccess the recording of our latest quarterly webinar held Thursday, December 14. |

Locator DataViews Training Guide

Interested in learning more about our Locator tool? Access the training guide and learn how to best leverage the tool. |

CBRE Insights & Research

The places in which we live, work and invest will continue to change and adapt to technology, demographics and human expectations at an accelerated rate. |